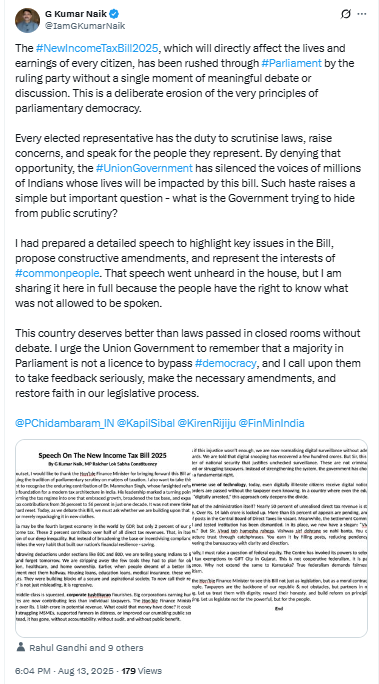

New Delhi/Raichur: Raichur Lok Sabha MP G Kumar Naik delivered a scathing critique of the New Income Tax Bill 2025, warning that it erodes hard-earned tax benefits for the middle class while granting undue advantages to large corporations. Naik thanked the Union Finance Minister for continuing the tradition of scrutiny on taxation matters but questioned whether the reforms were genuine or merely “repackaging in new clothes.”

Naik recalled the contributions of former Prime Minister Dr. Manmohan Singh, crediting his leadership for expanding the tax base and increasing direct tax contributions from 36% to 56% in a decade. However, he argued that the current Bill punishes savings—the very foundation of India’s financial resilience—by removing deductions under Sections 80C and 80D.

“These deductions helped young Indians plan for old age, healthcare, and housing,” Naik said. “Calling their removal ‘reform’ is misleading and regressive.”

Corporate Gains, Public Losses

The MP accused the government of promoting corporate tushtikaran (appeasement of big business) while squeezing the middle class. He claimed that corporations earning hundreds of crores contribute less than individual taxpayers, with over ₹1 lakh crore in potential revenue forgone. “That money could have revived MSMEs, supported distressed farmers, or improved public services,” he asserted.

Digital Surveillance and Administrative Gaps

Naik also criticised the “normalisation” of digital surveillance without safeguards, claiming it violates citizens’ rights. He highlighted administrative inefficiencies, including ₹14 lakh crore of unrealised tax revenue, 85% pending appeals, and a third of key tax board posts lying vacant. He lamented the dismantling of the Settlement Commission and warned that catchphrases like ‘Vivad se Vishwas’ cannot replace genuine trust-building.

Federal Equity Questioned

Calling the selective tax exemptions to Gujarat’s GIFT City an example of partisan preference, Naik demanded the same benefits for Karnataka. “True federalism demands fairness, not favouritism,” he said, urging the Finance Minister to treat taxpayers as “partners in nation-building” and legislate for the people, not the powerful.