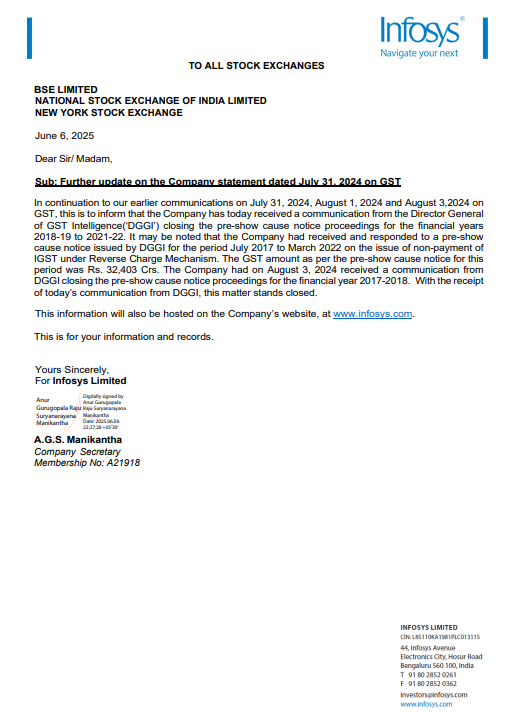

New Delhi/Bengaluru: The Director General of GST Intelligence (DGGI) has officially concluded the pre-show cause notice proceedings against Infosys for the financial years 2018-19 to 2021-22, involving a Goods and Services Tax (GST) amount of ₹32,403 crore, as stated in the company’s recent statutory filing.

In its announcement, Infosys, India’s second-largest IT firm, confirmed that with the receipt of this communication from the DGGI, “this matter stands closed.”

The company elaborated, “In continuation of our previous communications dated July 31, August 1, and August 3, 2024, regarding GST matters, we wish to inform stakeholders that we have received a notification from the DGGI, officially closing the pre-show cause notice proceedings for the financial years 2018-19 to 2021-22.” This statement was made in a filing late Friday evening.

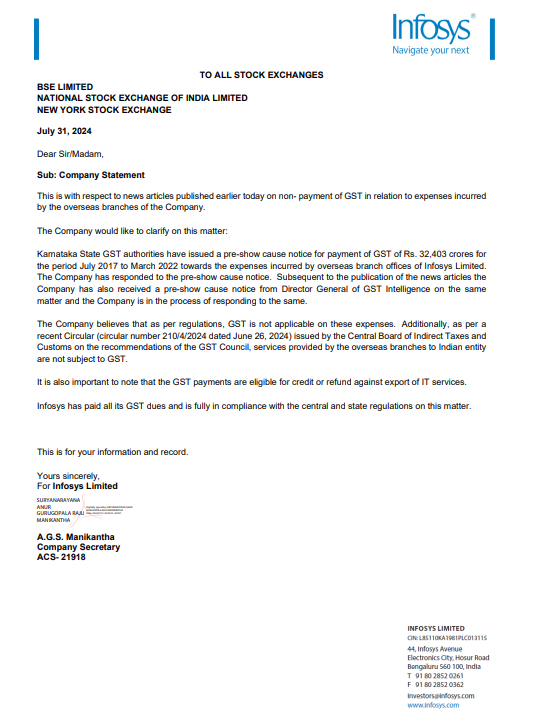

Infosys noted that it had previously received and responded to a pre-show cause notice issued by the DGGI concerning the non-payment of Integrated Goods and Services Tax (IGST) under the Reverse Charge Mechanism for the period from July 2017 to March 2022.

The GST amount cited in the pre-show cause notice for this period was ₹32,403 crore. Notably, on August 3, 2024, Infosys received a communication from the DGGI that closed the pre-show cause notice proceedings for the financial year 2017-18. With today’s notification from the DGGI, the company has confirmed that this matter is now resolved.